Negotiating Committee – May 8, 2025

| Reorganizing for Strength! |

|

| Fellow Pilots,Management’s “Poverty” = Profitability

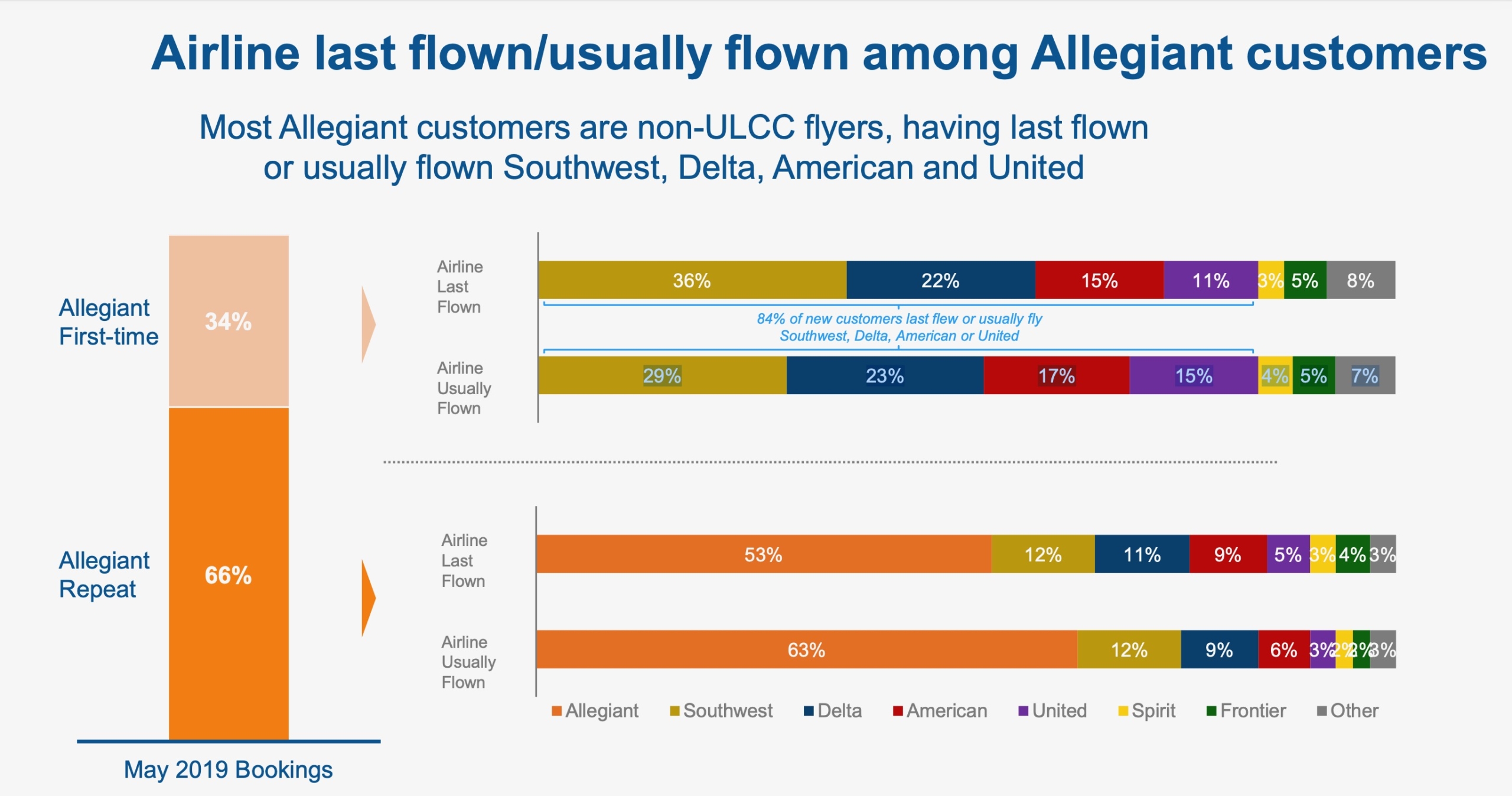

This week, Allegiant reported its Q1 earnings; empirical data strikes again. Management’s repeated claims during bargaining of financial “inabilities” fall on deaf ears, as the financial performance you delivered led the industry. During the call, management boasted of an industry-leading 18.1% EBITDA margin. That margin is 25% higher than Q1 2024, and the airline’s Operating Income margin is at least double that of jetBlue, Southwest, Frontier, United, or Delta. Remember, margins are scale-neutral and are used to compare the relative financial performance of carriers of different sizes. Allegiant is undeniably among the head of the pack. Despite the accrual of your retention bonus and a new Flight Attendant contract, Cost per Available Seat Mile (CASM) actually decreased compared to Q1 2024. On the operational front, our pilots continued to deliver a controllable completion rate of 99.2% on 32,000 departures for the quarter. This is despite management’s previous false claims that cancellations are largely driven by the Bloch Award. Consider these data points from the last earnings call: Revenue Growth: Airline operating revenue increased by 5.7% to $668M in the 1st Quarter, which is historically the worst financial quarter for U.S. airlines. Profit Margin Growth: Airline operating income increased by nearly 150% (not a typo) to $60.9M, delivering a 9.3 % operating margin, double that of United or Delta. Operating margin increased from 3.8% in 2024, an increase of 5.3 percentage points. Huge EBITDA Margins: Adjusted airline-only EBITDA margin was over 18%—well above any LCC/ULCC and nearly double most legacy carriers. Cost Decrease: CASMex minus special charges decreased by 9%, including the accrual of the pilot retention bonus and the new Flight Attendant Contract. Ancillary Gains: Even without increasing base fares, ancillary revenue increased by nearly 5% per passenger. Utilization Increase: Utilization has increased by 20% YoY. Scaled Reliability: 99.9% controllable completion rate with a 14% increase in capacity crushing the company’s claims that reliability and growth were impacted by the 0% unstacked, protecting, post-Bloch Award CBI solution. This is pure profitability, not poverty. The company is not in “survival” mode despite management’s claims to the contrary. Despite this excellent performance and strong demand for leisure travel, management continues to insist that a concessionary contract with worse-than-Spirit rules and below average with extreme and unprecedented levels of forced flying is critical for their “survival”. The answer is no. Our position is strengthened by data and the parties remain at an impasse. Who are our Customers and Competitors? Management insists that carriers like Spirit, Frontier, Avelo, and Sun Country are those that they “directly compete with.” Data strikes again (and not in their favor). Management has made it crystal clear to Wall Street that Allegiant is not a ULCC by classification or business model, and none of the aforementioned carriers are our “direct competitors”. Why they feel the need to lie to you is a mystery, but it is a fact that less than 5% of Allegiant’s customers come from Frontier (and only 3% of them from Spirit). Consider the following from management’s presentation to Wall Street:

Figure: Passenger Composition, Allegiant Investor Presentation 84 % of new Allegiant customers are customers of the “Big 4” — Southwest, Delta, American, or United. In fact, Allegiant has a 40 %+ Total Revenue per Available Seat Mile (TRASM) advantage over both Frontier and Spirit (even at nine pilots per aircraft). TRASM, by management’s own admission, is more aligned with brand carriers like jetBlue and Alaska than ULCCs. A fair, truly market-based contract for the pilots who deliver this industry-leading performance is revenue and margin-accretive, and non-negotiable at this juncture. Former Allegiant COO Speaks Out About JV

The Viva JV in its current form is simply about outsourcing U.S. pilot jobs and flying opportunities, and not about expanding “consumer access” to international markets. When management claimed this JV would be “revolutionary” for international travel, Bricker countered:

When management claimed that the JV is necessary to gain sufficient access to Mexican markets and compete with legacy carriers, Bricker noted that carriers with far fewer resources than Allegiant—including Breeze and Sun Country—already serve Mexico with U.S. based crews and no joint venture.

This is not Allegiant’s first attempt to outsource flying—your 757 flying to Honolulu was proposed to be outsourced to Ryanair until pilots drew a line. The time is upon us to draw the line again. Allegiant can launch Mexico service with Allegiant pilots presently, if they choose. This Union will continue to oppose any venture that does not protect U.S. jobs and guarantee Allegiant pilots their fair share of future growth and flying. You can read the full article here. Fort Lauderdale Transition MOU Fort Lauderdale (FLL) is among the bases next in line for a fleet transition from A320 to B737. In an email to the FLL pilots in reference to the transition, Captain Hardesty bravely claimed that the MOU “should not be controversial, as it is already part of the Section 12 AIP that the union and company have negotiated and agreed to”. Whether this is ignorance of the bargaining process or a blatant contempt remains uncertain. Any agreement achieved during collective bargaining over a new CBA is not available for implementation on an individual basis. As with any agreement, and especially an AIP, those terms are contingent upon the remaining outstanding terms in the contract. An AIP may become a full language TA, or it may not, but agreements on individual parts of the contract do not take effect until there is a complete, ratified contract. Management cannot cherry-pick agreements (or portions thereof) achieved during bargaining that they want to implement or “lock in” at their convenience via MOU. That’s not how it works; every pilot labor Union agrees. Management’s statement that it is not “controversial” to attempt to use an MOU to secure terms currently under dispute in bargaining is absurd. Manufacturing a controversy to erode pilot trust in the Union and force the Union to accept terms outside of bargaining is not good faith bargaining. Further, management inferred that the FLL pilots would be harmed by their requirement to adhere to the terms of the CBA. This is false. First, management has the means within the CBA to minimize or eliminate any hardship the affected pilots would face by opening the requisite number of vacancies (with appropriate excess) for B737 Captains and First Officers in FLL. This ensures that those pilots who wish to remain in FLL have every opportunity to do so. Management suggested that they would not/could not do so, yet since the Union held its ground and rejected the MOU, it appears that they have done exactly that. Second, those pilots who choose not to bid for the B737 in the vacancy will be afforded their displacement rights per the CBA, despite any management claim to the contrary. If the Company deviates from the CBA, the union will take all necessary action to defend the rights of the pilot group. Our contract must be followed. TAs or AIPs achieved during bargaining do not change that. Management should be aware that no agreements achieved during bargaining are available on an individual, piece-meal basis. If they want those terms, sign a new contract. Misleading Capacity “Reductions” Management will continue to sound the economic alarm to create fear and doubt in our pilot group. Regarding their statements about capacity reductions, it is worth noting that these reductions are still increases in year-over-year (YoY) figures. For example, August is still a 16% increase in ASMs and a 17% increase in block hours YoY. While management may wish to induce panic, the data shows that this is not a panic-inducing scenario in any sense. While it is reasonable to expect that Allegiant may slow some growth to match the economy, they will likely grow faster than most other U.S. airlines. Your expectations for a fair, market-based contract should remain unchanged. General Bargaining Updates The company has until Tuesday, May 13th, 2025, to submit their comments to the NMB in reference to our proffer of arbitration request. We will keep you informed of further developments as they occur. In Closing Since bargaining began, this management group has given you few reasons to trust them. They continue to erode the little remaining trust, if any, through their backhanded tactics (LAX MOU, training center rumors and leaks, etc.) on an almost hourly basis. Despite this, they will do everything possible to convince you that your Union is the problem. This management team can’t even offer the market‑based working conditions that peer carriers already provide their pilots. These provisions work with Allegiant’s “unique” business model as have been proven through testing and empirical data. Even still, they will tell tall tales to any pilot willing to listen. “Your Negotiating Committee is the problem,” they’ll say. “They just don’t want a contract,” they’ll claim. Give that some serious thought. Your Negotiating Committee isn’t on a special pay scale or receiving some direct retirement contribution/pension/stock option scheme you don’t get. We are a committee of your peers, and there is absolutely no motivation for us to delay a fair contract – we get better work rules and raises at the same time you do. Management is a different story. Delays save them money and wear you down. They want to stall a fair contract because it’s in their best interest. They will delay and string you along until you demand, in unison, that management deliver a fair, market-based contract to our pilots immediately, beginning with resolving the current impasse by accepting the Union’s data-based unstacking proposal. Your Negotiating Committee will continue to prepare each day to get this contract across the finish line through data analysis, strategy, and preparation, and provide you with as much information as is permissible so you can remain engaged and informed. It is time to stand together, unified, unapologetic about what you deserve, without fear of management or the vocal minority who believe you are worth concessions. Stand behind your brothers and sisters in the fight for what you deserve. We must show respect and dignity for our profession; we can’t wait for another carrier to carry the torch for us in hopes to pattern bargain from their efforts a decade from now. Every other pilot group has fought hard for what they have. The Allegiant pilots must do the same. The unique distinction of having both industry-leading financial performance and an industry-worst pilot contract ends now. Four years in negotiations will not result in concessions or backwards progress. An immediate, fair, market-based contract is the only option we will accept at this juncture in negotiations. In Unity, Captain Joshua Allen Captain Jay Killen Captain Brad Keller Captain J.R. Lynch Captain Jim Cole |

|

|

Copyright (C) 2025 Allegiant Pilots Association, Teamsters Local Union 2118. All rights reserved. You are receiving this email as a member of APA Teamsters Local 2118. |